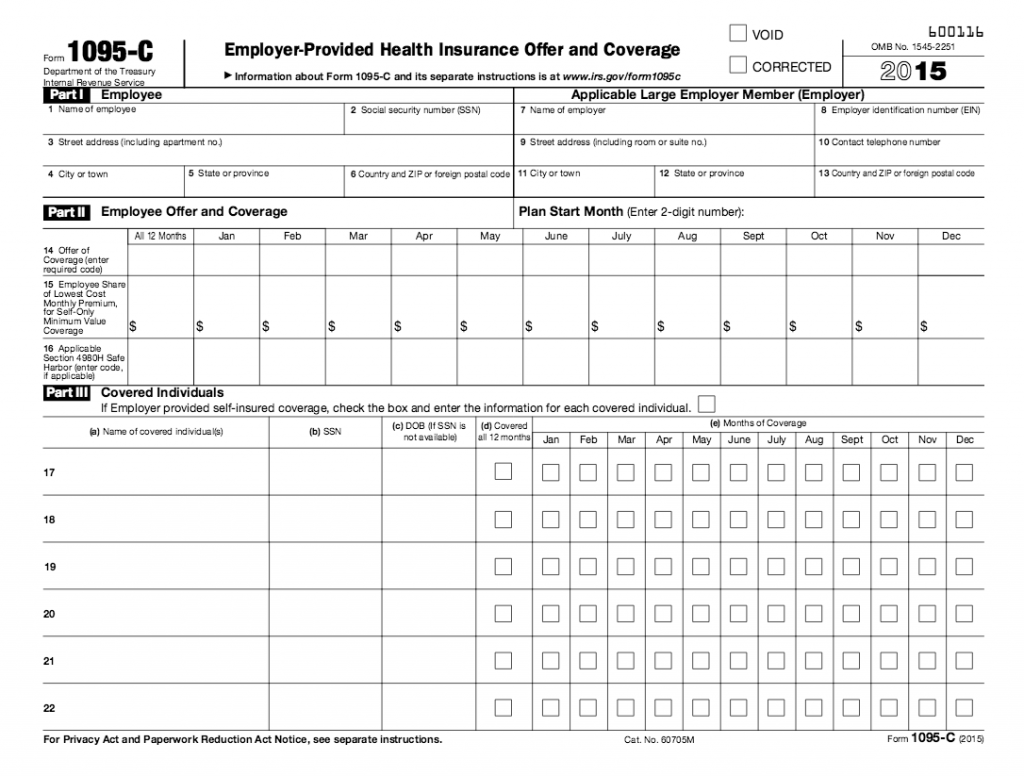

NEW TAX FORM 1095-C [bs_row class=”row”]

[bs_col class=”col-sm-4″]

Click to enlarge

[/bs_col]

[bs_col class=”col-sm-8″]

If you are in a full-time, benefit-eligible position or in a part-time position and enrolled in the University’s Employee Health Care Plan, you will receive a Form 1095-C at the end of January. This form will confirm the university’s offer of health coverage to you and your enrollment (if enrolled), together with an enrollment confirmation for any other enrolled family members.

Based on the difficulties many employers are experiencing in creating these new forms, the IRS has extended the deadline for delivery of individual employee forms to March 31, 2016. The university will provide the forms to employees as soon as possible. (This extension does not apply to W-2 forms – they will be available by the end of January.)

You do not need to send the Form 1095-C with your taxes. If you wish to file your taxes prior to receiving your Form 1095-C and you are unsure of the months in which you had coverage through the university or whether you were eligible for a premium tax credit for coverage you obtained through the Federal Marketplace, please contact the Benefits Department at 801-581-7447.

For information about Form 1095-C, see the Benefits Department’s Web page at hr.utah.edu/benefits/1095C.php.

Consent to receive your Form 1095-C and W-2 electronically. If you elect to receive the forms electronically, you will be able to view and print both forms at any time. Login to CIS and click on the “1095-C Consent Form” link in the “Employee Self Service Apps” section.[/bs_col]

[/bs_row]